portland oregon sales tax rate 2020

Start managing your sales tax today. This is the total of state county and city sales tax rates.

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Oregon is one of 5 states that does not impose any sales tax on purchases made in.

. The state sales tax rate in Oregon is 0000. Portland Tourism Improvement District Sp. Tax rates last updated in January 2022.

Please complete a new registration form. Multnomah County Business Income Tax rate. The tax would apply to retailers with more than 1 billion in national sales and.

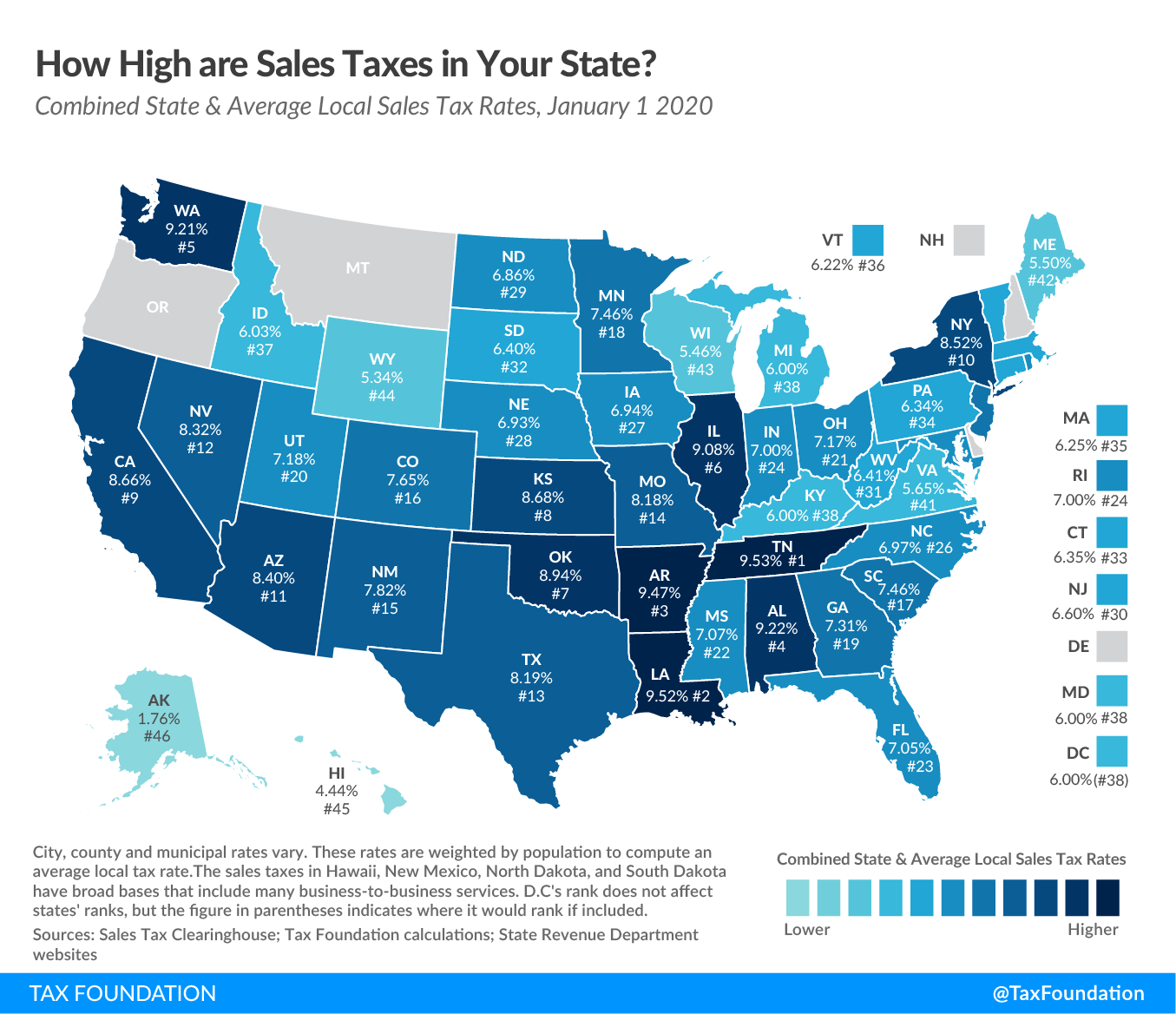

These rates are weighted by population to compute an average local tax. The average cumulative sales tax rate in the state of Oregon is 0. Oregon state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with OR tax rates of 475 675.

There are six additional tax districts that apply to some areas. The Oregon sales tax rate is currently. Sales tax About sales tax in Oregon Oregon doesnt have a general sales or usetransaction tax.

The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. A home tax assessed at 242000 a real market value of. Automate sales tax calculations reporting and filing today to save time and reduce errors.

That means that your homes value may stay the same this year or even go down a little bit but in the parallel universe of Oregon property taxes the value is still going up 3. Oregon cities andor municipalities dont have a city sales tax. Nor Portland Oregon impose any state or local sales taxes.

2020 Tax Rate 475 675 875 99 Single and Separate 3600 3600 - 9050 9050-125000 125000 Joint and Head-of-Household 7200 7200 - 18100 18100-250000 250000. Oregon cities andor municipalities dont have a city sales tax. Compare sales tax rates by city and see which cities have the highest sales taxes across the United States.

This takes into account the rates on the state level county level city level and special level. Start a trial Contact sales. Fast Easy Tax Solutions.

This is the total of state county and city sales tax rates. Oregon Income Tax Rate 2020 - 2021. For example under the South Dakota law a company must collect sales tax for online retail sales if.

The minimum combined 2022 sales tax rate for Portland North Dakota is. The company conducted more than 200. There are no local taxes beyond the state rate.

The tax will apply to tax years beginning on or after January 1 2019. State Local Sales Tax Rates As of January 1 2020. Exact tax amount may vary for different items.

City of Portland Business License Tax rate. 2022 Oregon state sales tax. In the Portland Metro area mill-rates range from 1500 to 2030.

What is the sales tax rate in Portland North Dakota. Ad Find Out Sales Tax Rates For Free. Business Tax Rates and Other FeesSurcharges Business Tax Rates.

Oregon Sales Tax Oregon does not collect sales taxes of any kind at the state or. To this end we show advertising from partners and use Google Analytics on our website. A City county and municipal rates vary.

Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities. Sales tax region name. The minimum combined 2022 sales tax rate for Portland Oregon is.

The companys gross sales exceed 100000 or. And in 2020 Lincoln Institute determined that Portland proper ranked in the top 5 in the entire country. The mill-rate varies from one community to another.

The County sales tax.

Most Beautiful And Best Skylines In The World How To Draw Skyline Travel With Me 24 X 7 Skyline Travel Around The World Skyline Drawing

Sales Tax On Blue Nile Jewelry Plus How To Avoid It

Oregon Economic And Revenue Forecast December 2019 Oregon Office Of Economic Analysis Economic Analysis Oregon Forecast

Sales Tax By State Is Saas Taxable Taxjar

موافقة لتر كدمة Oregon State Income Tax Calculator Poksipon Com

Consumer Inflation Rate Was 8 0 In May 2022 Finance

Sat Open House Craftsman Style Home Real Estate Lincoln City

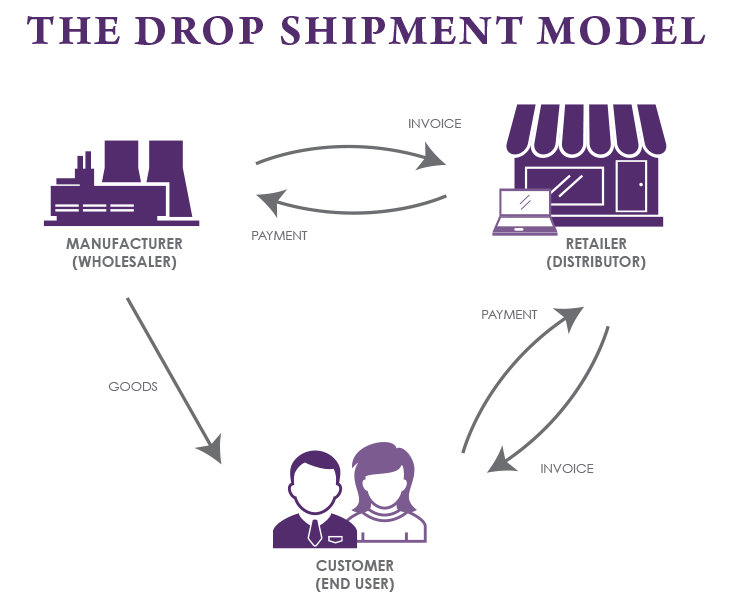

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Is It Possible To Buy A New Apple Device Without Any Sales Tax Appletoolbox

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

Price Of Osb Up More Than 500 Since January 2020 Eye On Housing